LOCATION:

Town home

CAUSE OF LOSS:

Fire caused by an electric hair straightener

COST OF LOSS:

$263,000

DETAILS OF LOSS:

The insureds’ daughter was the last to leave the home in the afternoon to go to work. When the

insureds’ arrived home later they noticed smoke coming from the windows. They went to neighbour’s

house and called the Fire Department. The dwelling and contents in the basement sustained heavy

fire damage, while the remainder of the home sustained smoke and water damage. The Fire

Commissioner investigated and determined the cause of the fire to be the hair straightener left on in

a bedroom located in the basement.

LESSONS LEARNED:

When using electric curling irons, hair straighteners or other appliances that generate heat, be sure

to unplug it after each use and place them in a secure position away from any flammable materials.

Never leave your home without checking to make sure any irons, curling irons, etc. are unplugged

and in a safe location.

Do you have lots of STUFF? Whether you are a tenant, condo owner or homeowner having a record of your belongings will always come in handy in the case of a claim. And they're also kind of fun to fill out!

Keeping an up to date record will help you stay organized in the case of a claim. Suffering any sort of loss to your dwelling can be an overwhelming experience, and having a list of the details of your belongings and their values makes going through the claims process much simpler and less stressful than having to recall everything off the top of your head. This list can also help you make sure your insurance coverages are enough to protect you in the case of a total loss.

You might even find this list handy for many other uses (maybe it will even spur a garage sale)!

You can print off a list of common household items and personal belongings here. We can even hang on to a copy in your file for you to make sure it is safe.

Do you have STUFF?

Did you know, your condominium building has insurance on the structure but no coverage for your belongings or any improvements that have been made to your unit? This is where Condo Insurance comes in. Whether you're living in the unit or renting it, Condo insurance is designed to provide you with that coverage your building lacks. Coverage for your belongings, for your renovations and upgrades, additional living expense, contingent coverage and building deductible assessment that keeps you protected if your building itself isn't adequately insured or the building deductible gets transferred to you. They all provide you with personal liability and can be upgraded to include several options, including:

- Increased Limits for property with specific amounts of protection, like jewelry or musical instruments

- Reduced Glass Breakage Deductible

- Sewer Backup

- Voluntary Firefighting coverage

- Watercraft coverage

- Seasonal Home coverage

- Rental Home coverage

You may be eligible for discounts if:

- claims free for over 3 years

- approved monitoring and security system

- fire resistive structure

- above third floor

- age and loyalty

- you choose a higher deductible

We ask that you take a moment to fill out a record of your belongings. You can print off an inventory worksheet to fill in values and year of purchase to most household items. Once you have a fairly complete list, add up the total replacement value plus an amount for restoration expense. This is what you will be wanting to base your coverage for under your contents. You can then contact us (1-888-450-2700), visit our office, or request a free quote online with this value we can discuss your options and what policy will best suit your needs and budget.

2015 looks to be another exciting and prosperous year across Saskatchewan. If you are a new business or maybe an existing business that would like a refresher or an update on their commercial insurance Al Hattie Insurance is here for you! Doing your research on what commercial insurance is best suited to your needs and understanding your coverages are a quick phone call away. Reach us during office hours to have any and all questions answered by one of our expertly trained and certified brokers toll free at 1-888-450-2700.

Commercial insurance can provide a wide array of coverages that in case of loss can be vital to your business and it's employee's. Tailored to suit your own needs, we can help you mold a flexible policy that will keep your business safe and sound. Most policies will ensure coverages against:

- Business interruption (loss of income, continuing expenses, and employee wages)

- Accounts receivable, builder's risk, contractor's equipment, and glass breakage

- Boiler, water heater and other machinery

- Liability claims: extension coverage can include personal and advertising injury liability, employer's liability, contingent employer's liability, tenant's legal liability, non-owned auto liability, non-owned aircraft liability

- Crime (employee dishonesty, theft of money or securities, burglary, robbery, forgery and counterfeit currency)

Let us wish all your business endeavours in 2015 great success, and please call us or stop in our office if you have any questions or concerns about your Commercial insurance policy!

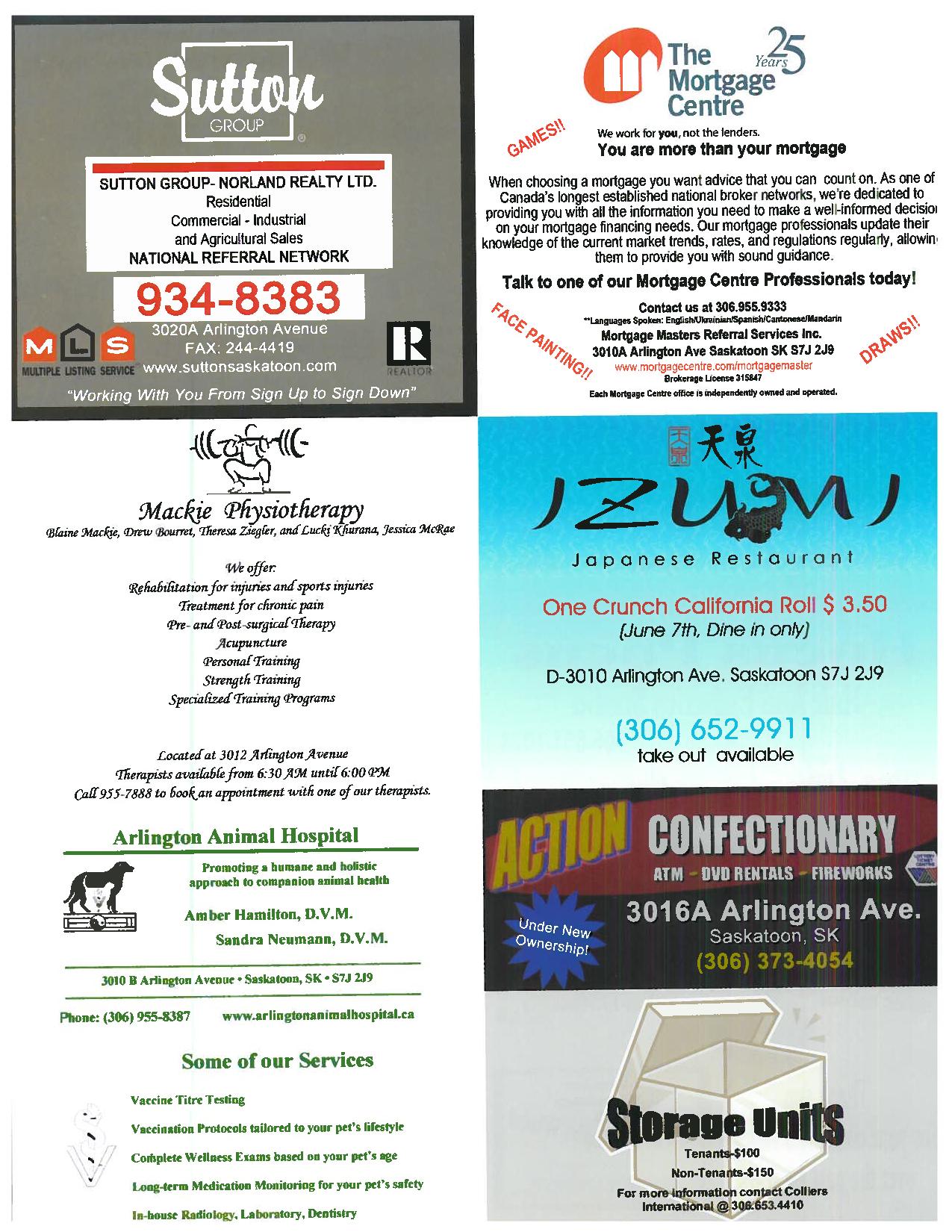

Join us on Saturday June 7th for our mall's Customer Appreciation Day! We will be hosting a Car Seat Clinic, a free Shred-It Station (with Food Bank donation) for your documents, and a free Child Find ID Clinic. The full day's event's can be found on the flyer below. Thank you from our family for having us as your Saskatchewan Insurance Brokerage for over 30 years!